Financial System:

Financial system is a set of arrangement of financial institutions, markets and instruments for mobilizing the resources. It can be also defined as a mechanism through which fund is transferred from the surplus units to deficit units. Or financial system is the system that allows the transfer of fund between saver and borrower. Financial systems are crucial to the allocation of resources in a modern economy. It facilitates resource transfer and mobilizes savings to the productive sectors thereby contributing to the economic development. The financial sector creates value by helping households, firms and governments to meet these basic needs.

Basic Needs Served by Financial System:

Making the payments of transactions, transfer of resources from surplus unit to deficit ones and protection of possible risks are the basic needs of trade to be served by the financial system. It is noteworthy that financial system makes the trade easy by serving these basic needs-payments, resource transfer and risk trading

There are three types of basic needs served by the financial system:

1. Payments

2. Resource Transfer

3. Risk Trading

1. Payments:

In the absence of modern financial system, traders faces many problems related to payment. They cannot make payment even though they have enough money to pay for their credit purchases. They will have to carry cash from one place to another. There could be the problem of theft of money in transit. Moreover, cost of payment in terms of time and money also increases. The development of modern financial system makes the payment simple and efficient. In credit sales, there is the problem of lack of trust. In such a situation, the bank may provide guarantee of payment to the seller on behalf of the buyer. There are number of ways that financial system provides the guarantee of payment to the sellers. Letter of credit is one of the examples in international trading. Now a days established global networks of payment system in financial market has made international trade possible and easy. Certain financial assets including checking accounts and negotiable order of withdrawal accounts serve as medium of payments. Credit cards issued by banks; New innovation in payment system; e.g., electronic payment system is leading towards simple, safe and cost reducing payment system. There are many two methods of payment: warehouse bank and clearing house.

Warehouse Bank

A warehouse bank is a bank that accepts deposits of cash, count, and authenticate the currency and store it in a solid and well-guarded vault. They allow depositors to make payments by transforming title to deposited cash rather than by transferring the cash itself, by writing check. The warehouse bank offer security and ease of payments in exchange for a fee.

Clearing House

Physically located place through which checks are cleared between two banks. When depositors maintain account at different bank then cash payment by one to another would by risky and inconvenient. The bank have an arrangement that makes such a physical transfer of cash unnecessary, and the arrangement is known as clearing. In this process nobody could pay the amount by physically delivering cash.

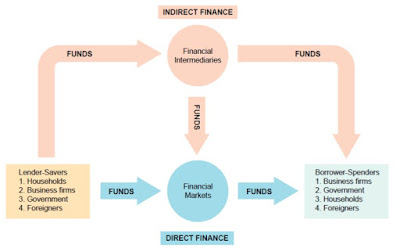

2. Resource transfer

The fund can be transferred from surplus units to deficit units through two channel; direct channel and indirect channel in an economy. These channels are also called direct financing and indirect financing. Deficit unit may need long term or short term funds or both short term and long term funds. Either they can borrow the funds from financial institutions such as commercial bank and financial company or they can borrow the needed fund from their relatives, friends etc. if they borrow the funds from financial institution then it is called indirect financing. And if they borrow the fund from their relatives then it is said to be direct financing.

Direct financing:

In direct financing the fund is transferred from surplus units to deficit units directly through financial market which reduces the cost of financing.

Indirect financing:

In indirect financing, the fund is transferred from surplus units to deficit units with the help of financial intermediaries such as banks and insurance company.

3. Trade in risk

In our daily life we have to face different types of risk such as accident due to which our dependent may suffer from the loss of our life. Similarly, business firm also face various type of risk and sustain the huge amount of loss from those risks. Financial system provides mechanism to minimize those risks through trading of risk. Trade in risk is the only way for individual, household and business firm to protect the loss from the possible events. There are two types of trade in risk-insurance and forward transactions.

Insurance:

Insurance is a type of contract in which one who do not face a particular risk agree to share the losses of those who do. There are two types of insurance-reciprocal insurance and external insurance.

Reciprocal Insurance is an agreement whereby those facing a particular risk agree to share their losses. Mutual aid and gift exchange are examples of reciprocal insurance.

External Insurance an agreement whereby those who do not face a particular risk agree to share the losses of those who do. (Natural risk such as losses from shipwrecked or satellite destroyed on launching).

Moral hazard and adverse selection are two main problems faced by the insurance companies.

Forward transaction:

It is an exchange of one promise for another: one party promises to buy, the other promises to sell. Forward transaction involves the default risk (replacement risk). The financial system helps in two ways to solve the problems in forward transaction: the direct forward transaction (future forward) and indirect forward transactions (forward intermediaries). They offer low transaction costs, guaranteed delivery, and greater liquidity.

Technology of financial system

Financial system uses different techniques (in single or in combination) to serve its basic needs which are known as the technology of financial system. Some of the technology used by financial system are described below;

1. Delegation

Rather than doing the things oneself, one can assign someone else to the work on his behalf. This is being done mostly to reduce costs and make the operations more efficient. The process of appointment of someone that may be an individual or an organization to act for other is known as delegation.

Advantage of delegation are:-

Reduction in transaction cost

Specialization

Strong bargaining

Reveling information

2. Credit substitution

Credit substitution is replacement of credit of one party to transaction with the credit of a superior party. For example, first bank receive the deposits and lend the same money to the borrowers. Here deposits is bank's credit and the lending amount is borrower credits. Thus the bank substitutes its own credit with the credit of its borrowers, similarly insurance company substitutes the credits of the members of the risk pool.

3. Pooling

Pooling is the combination of the assets or liabilities. For example bank provides many loans to different types of borrowers. Similarly it collects deposits from different types of depositors. In this example, bank is pooling the assets and the liabilities. By pooling the assets financial institutions can verify the risks and reduce the risk and improve the liquidity.

4. Netting

Netting is the offset of one transaction against another. For example, suppose A and B have account in a same bank. A sell goods for Rs. 5000 to B in credit in the first week of January. In the second week of the same month, B sells goods for Rs. 4500 to A on the same term. Here four transaction can be offset with one transaction if B transfer Rs. 500 directly from his account to A’s account.

Transactions

– B withdrew Rs. 5000 from bank.

– B paid Rs. 5000 to A.

– A paid Rs. 4500 to B.

– A deposited Rs. 500 in Bank.

Transactions

– B withdrew Rs. 5000 from bank.

– B paid Rs. 5000 to A.

– A paid Rs. 4500 to B.

– A deposited Rs. 500 in Bank.